Whether you're trying to benchmark your performance or uncover the secrets of the world's most successful companies, performance statistics can be incredibly valuable.

While there's a ton of SaaS-specific data around, it's locked-up in dozens of unwieldy, complicated studies. So to make life a little bit easier, I've collated over 50 of the most insightful and interesting SaaS statistics around, looking at all aspects of growth and performance.

SaaS statistics are only as valuable as the insight you can extract from them, so for each section, I've picked out a couple of key takeaways. These high-level ideas should provide a good starting point for you to learn from the world's most successful SaaS companies, and start improving the performance of your own SaaS business.

SaaS Growth Statistics

KEY TAKEAWAYS

It isn't enough to grow: your SaaS company needs to grow faster than your competitors.

The biggest SaaS companies tend to be the fastest growing, in terms of revenue and team size.

It's significantly cheaper to upsell and retain than it is to acquire new customers.

The fastest growing SaaS companies generate $3.9 in revenue for every $1 they lose to churn.

- If a software company grows at 20% annually, it has a 92% chance of ceasing to exist within a few years. (Tomasz Tunguz)

- The median cost for a SaaS company to acquire a dollar of new customer revenue is $1.18. (ForEntrepreneurs)

- It's 4x cheaper to upsell existing customers than acquire new customers: costing just $0.28 to acquire an additional dollar of revenue. (ForEntrepreneurs)

- It's 9x cheaper to retain existing customers than acquire new customers: costing $0.13 to acquire any additional dollar of revenue. (ForEntrepreneurs)

- 86% of SaaS businesses treat "New Customer Acquisition" as their highest growth priority, both in terms of executive support and funding available. (Totango)

- 56% treat "Existing Customer Renewals" as high priority. (Totango)

- 54% treat upselling and add-on sales as high priority. (Totango)

- Publically-traded SaaS companies have an average Revenue Per Employee of $200,000. (Tomasz Tunguz)

- The fastest growing SaaS companies scale their organisations extremely rapidly: growing their teams by an average of 56% each year. (Tomasz Tunguz)

- The median startup spends 92% of first year revenue on customer acquisition, taking 11-months to payback their Customer Acquisition Cost. (Tomasz Tunguz)

- The fastest growing SaaS companies have an average Quick Ratio of 3.9: generating $3.9 in revenue for every $1 lost to revenue churn. (Insight Squared)

SaaS Churn Statistics

KEY TAKEAWAYS

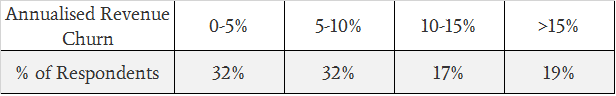

Churn appears to be strongly correlated with company growth, and bigger companies are likely to have lower churn.

The fastest growing SaaS companies also prove to be the most adept at reducing and controlling their revenue churn.

Churn is difficult to control, with a near equal proportion of SaaS businesses seeing increases, decreases and no change in their churn levels.

Many SaaS companies conflate monthly revenue churn and annual revenue churn: while a 5% annual revenue churn is something to aspire to, 5% monthly churn will kill your business.

- Best-in-class SaaS companies achieve 5-7% annual revenue churn - equivalent to a loss of $1 out of every $200 each month. (Sixteen Ventures)

- The median monthly revenue churn for large SaaS companies is 0.75%, translating into an annual revenue churn rate of 10%. (Tomasz Tunguz)

- In contrast, the median churn rate for smaller, private SaaS companies with less than $10M in revenue is 20%. (Chaotic Flow)

- 36% of SaaS businesses managed to reduce their revenue churn over the last 12-months. (Totango)

- 30% saw an increase in annualised revenue churn, and the remaining 34% managed to keep their churn rates constant. (Totango)

- 39% of the fastest growing SaaS companies were able to keep their yearly revenue churn below 5%. (Totango)

- In contrast, only 30% of medium growth companies, and 29% percent of low growth companies, were able to maintain a revenue churn rate below 5%. (Totango)

SaaS Pricing Statistics

KEY TAKEAWAYS

Small improvements to your pricing strategy can yield massive improvements to your revenue and growth.

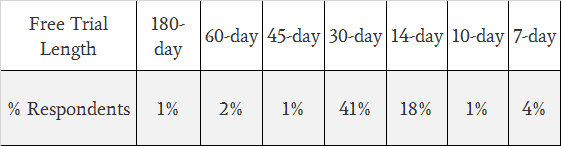

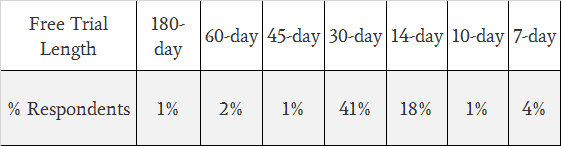

Less than half of SaaS companies offer a free trial: a figure which appears to be declining. Of those free trials, the most common trial length is 30-days.

Almost half of all SaaS companies still rely on user-based pricing.

- A 1% increase in pricing strategy yields an average 11% increase in profit. (Harvard Business Review)

- The average SaaS company spends just 6 hours determining their pricing strategy. (Price Intelligently)

- 44% of SaaS companies offer a free trial. (Totango)

- 41% of free trial-offering SaaS companies use a 30-day trial. (Totango)

- 18% offer a 14-day free trial. (Totango)

- 17% use a freemium pricing model. (Totango)

- 41% list their pricing on their website. (Totango)

- 46% of SaaS businesses have "per user" pricing strategies. (Totango)

SaaS Sales Statistics

KEY TAKEAWAYS

Lead quality and deal size are more important to rapid growth than number of leads alone.

It costs significantly more to acquire a new customer than it does to upsell or retain existing customers.

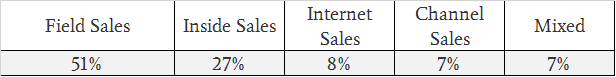

Sales models change dramatically as companies grow. Internet sales methods are much more popular with smaller SaaS startups, but the demands of scaling mean that most large, post-investment SaaS companies quickly make the switch to more "traditional" sales methodologies - often in spite of significantly higher CAC.

- High-growth SaaS companies generate 40% more leads, per month, than their slower growing counterparts. (Insight Squared)

- However, those same high-growth companies generate 60% fewer sales opportunities than low-growth companies. (Insight Squared)

- High-growth SaaS companies close deals that are 2.8x the average size of deals closed by low-growth companies. (Insight Squared)

- Active trial users that are contacted by a sales rep are 70% more likely to buy the paid service than those that aren't. (Totango)

- 51% of large (revenue >$2.5million) SaaS companies use field sales as their primary method of distribution. (ForEntrepreneurs)

- In contrast, only 8% of large companies use internet sales strategies. The proportion of companies relying on internet sales increases as company size decreases. (ForEntrepreneurs)

- To generate a single dollar of new customer revenue, Field Sales strategies have an average Customer Acquisition Cost (CAC) of $1.14. (ForEntrepreneurs)

- In contrast, Internet Sales strategies have a significantly lower CAC of just $0.42. (ForEntrepreneurs)

- Internet sales strategies are the only sales method to see a decline in CAC, dropping from $0.54 to $0.42 between 2014 and 2015. (ForEntrepreneurs)

SaaS Conversion Rate Statistics

KEY TAKEAWAYS

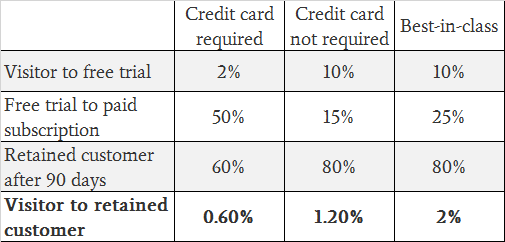

If you want to maximise the number of retained customers generated from your free trial, don't ask for a credit card.

Best-in-class SaaS companies achieve a 2% end-to-end (visitor to paying customer) conversion rate.

- If a free trial requires a credit card, the average visitor to retained customer conversion rate is 0.6%. (Totango)

- If a credit card is not required, the visitor to retained customer conversion rate increases to 1.2%. (Totango)

- SaaS companies that allow sign-ups without a credit card generate twice as many paying customers from their free trial. (Totango)

- Best in class SaaS companies achieve a visitor to retained customer conversion rate of 2%. (Totango)

SaaS Customer Success Statistics

KEY TAKEAWAYS

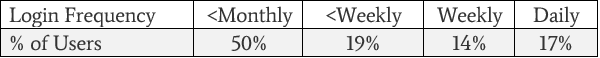

The vast majority of SaaS users login to a service once a month (or less), creating a real need to actively engage users and increase their time spent within the solution.

Upselling appears to have a real impact on growth, with the fastest growing SaaS companies reporting much higher upselling than smaller, slower growing companies.

- 50% of paying customers log in to their SaaS service less than once a month (or not at all). (Totango)

- Just 17% of paying customers login to their SaaS service on a daily basis. (Totango)

- The median SaaS business generates 16% of its new Annual Contract Value (ACV) from upselling to existing customers. (RJMetrics)

- The largest SaaS companies (>$75million yearly revenue) attribute 2.5x as much new revenue to upselling than the smallest SaaS companies (<$1.25million): 28% versus 11%. (RJMetrics)

- The top 50% of the fastest growing SaaS businesses generate much higher upsells than their competitors. The larger the business, the greater the impact of upselling. (Tomasz Tunguz)

SaaS Investment Statistics

KEY TAKEAWAYS

Investment as a whole is increasing, and the majority of this growth is taking place in the enterprise.

It's possible to raise Series A investment without a single dollar in revenue: just don't count on it.

To become a unicorn, a SaaS company needs to raise an average of $206 million in funding.

- SaaS IPOs have more than doubled over the last 12 years. (Tomasz Tunguz)

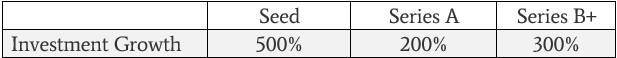

- All types of investment have grown, year-on-year, with the biggest growth during the seed stage of financing. (Tomasz Tunguz)

- 80% of venture capital investments take place in the enterprise. (Tomasz Tunguz)

- When venture capitalists participate in seed rounds, the average round size is 3x larger. (Tomasz Tunguz)

- The fastest growing SaaS companies raise an average of $9.5M in Series A funding. (Tomasz Tunguz)

- 27% of these companies were able to raise Series A investment with $0 in MRR - relying on networks and previous ventures to provide their credibility. (Tomasz Tunguz)

- Average round size has been increasing by 11% per year. (Tomasz Tunguz)

- For SaaS companies valued at over $1billion, the median amount of financing raised is $206million. (Tomasz Tunguz)